Mobile Banking App Development

Mobile Banking App Development for Clane, a Financial Technology Ecosystem on a Mission to provide Financial Services to its Users

Mobile Banking App Development for Clane, a Financial Technology Ecosystem on a Mission to provide Financial Services to its Users

Mobile banking has become increasingly popular as people look for more convenient and secure ways to manage their finances. One of the key developments in this field is the creation of banking mobile apps that provide users with a modern platform to foster communication between other mobile finance applications.

The main goal of the development of this app was to keep everything in one place, clear, user-friendly, quick, and easy, saving the user’s time.

The result of the mobile banking app development is the ability which provides users with access to a broad spectrum of banking services, from checking their account balances and transaction history to transferring money between accounts and paying bills. The app is created to be easy to use, with intuitive interfaces that make it comfortable for users to navigate the app and complete transactions fast and efficiently.

The app offers features such as biometric login, which adds an additional important layer of security to protect the user’s personal and financial information.

One of the key advantages of the mobile banking app is its integration with other mobile finance apps. User can link their bank account to a budgeting app, investment app, or payment app so that all of their financial information is consolidated in one place, which can help to stay on top of finances and make informed decisions about managing money.

With the ability to complete transactions on the go, users no longer need to visit a physical branch or wait on hold to speak with a customer service representative. It’s possible to log in to the app and complete transactions quickly and efficiently, which is helpful for busy people who need to manage finances on the go.

The mobile banking app also offers advanced security features to protect users’ personal and financial information: two-factor authentication, biometric login, and encryption of sensitive data. With these features in place, users can rest assured that their information is safe and secure.

Clane banking mobile app provides users with a modern and user-friendly platform to manage their finances. With the ability to integrate with other mobile finance applications, save time, and provide advanced security features, the app is becoming increasingly popular among users who want to stay on top of their finances in a fast-paced, mobile world.

The app's main screen offers a convenient and accessible user interface, requiring only a single click to navigate to other app features. By relocating a button to the bottom navigation menu, users can easily manage the app's functionalities, including account management and transaction history.

A side menu allows users to access additional features and services, such as customer support or secure messaging, and stay informed about crucial business updates and financial news. This design provides a seamless and user-friendly experience, ensuring customers can access and manage their financial information quickly and efficiently.

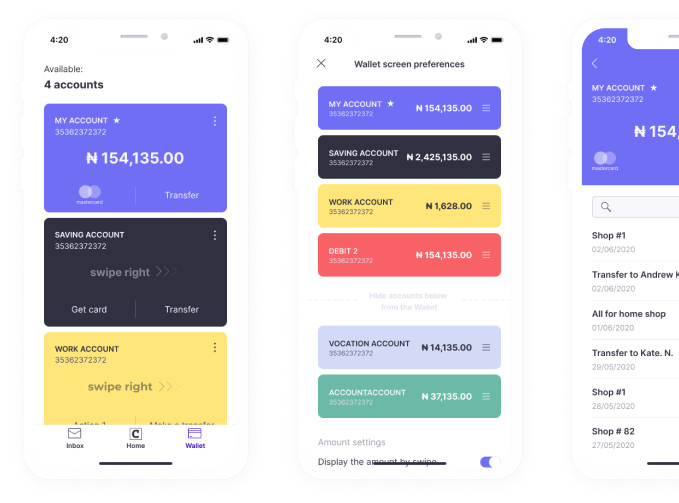

One of the most valuable features of the mobile banking app is Wallet.

The Wallet is designed to collect all of a user's bank accounts in one place, allowing customers to easily view their account balances and access their account information with just a few taps on their mobile devices. With quick actions available within the app, customers can perform common banking tasks, such as transferring funds between accounts, paying bills, and checking their transaction history quickly and easily.

One of the significant advantages of the Wallet is its flexibility. Customers can reorganise their accounts in the app to suit their specific needs and preferences. Whether they prefer to group their accounts by type, institution, or account activity, the app's design allows for customisation and personalisation.

The security of the mobile banking app is also a major consideration in its development. Advanced encryption technology and multi-factor authentication are employed to ensure the safety of customers' financial information.

As the popularity of mobile banking continues to grow, the Wallet feature will undoubtedly become an increasingly vital component of any bank or financial institution's mobile banking app. The app was developed to give users a powerful tool to manage their finances quickly, efficiently, and securely. By providing users with a complete overview of their accounts and transactions, Wallet makes it easier to stay on top of their financial health.

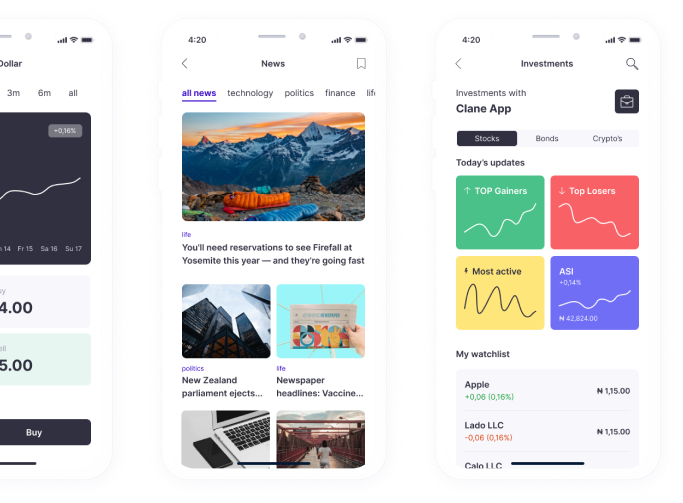

Want to convert money? No problem. Watch for fluctuations in the investment market and quickly access your investment portfolio. With the most up-to-date news, which you can bookmark — you will be the first to know it all.

One of the app's key benefits is real-time monitoring of your portfolio. With just a couple of taps, you can view your current holdings, check your performance over time, and adjust your investments as needed, allowing you to stay on top of your investments and make informed decisions about buying, selling, or holding your assets.

Also, the app allows watching for fluctuations in the investment market. You can set up alerts for specific stocks or indices, so you are notified when they reach a certain price or experience a significant change, enabling you to make timely decisions and take advantage of market opportunities.

Another helpful feature of the banking app is the ability to convert currencies on the go. Whether you travel abroad or need to send money to a friend, colleague or family member in another country, you can easily convert your funds with just a few taps. This can save you time and money compared to traditional currency exchange methods.

Up-to-date news and analysis from leading financial sources can assist you in remaining informed about the latest trends and developments in the financial world, making the right investment decisions and staying ahead of the curve.

Order a virtual or physical card via the app, and choose the design you like. Manage your card easily.

Ordering a banking card through a mobile app has several benefits. First and foremost, it is incredibly convenient. You no longer need to visit a physical branch to order a new card or manage your existing card. Instead, you can log in to your mobile banking app and order a virtual or physical card with just a few taps, saving you time and hassle, especially if you have a busy schedule.

The mobile banking app was developed to allow users to select their preferred design. You can choose a design that reflects your personality or interests or matches your favourite colour scheme, allowing you to personalise a card and make it unique.

Accept payments from anyone with your mobile phone via contactless payment solutions such as Pay with Bluetooth. With Pay with Bluetooth, merchants can accept payments from anyone with a mobile device, making transactions faster and more seamless than ever.

One of the critical benefits of Pay with Bluetooth is its ease of use. You no longer need to carry cash or credit cards with you – all you need is a mobile phone. The process is fast and straightforward, with payments typically completed in just a few seconds. It is ideal for merchants who need to process large volumes of transactions quickly, such as those in the food and beverage industry.

If you need software for your business, please get in touch with us. We are happy to discuss your ideas, understand your goals, and develop software to move your business ahead.

Get the commercial proposal within 24 hours. Start your project within 7 days